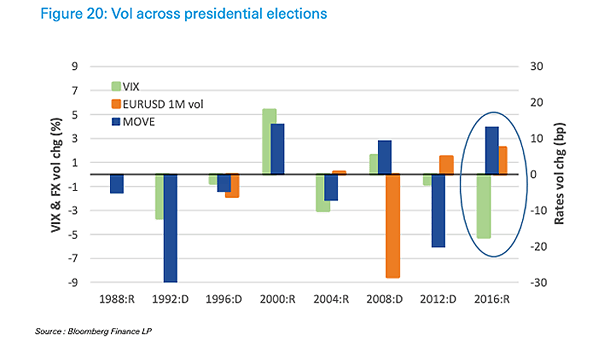

Volatility Across U.S. Presidential Elections

Volatility Across U.S. Presidential Elections Chart showing that outside of recessions, U.S. presidential elections did not contribute much to the volatility of equities, rates and forex. Image: Deutsche Bank Global Research