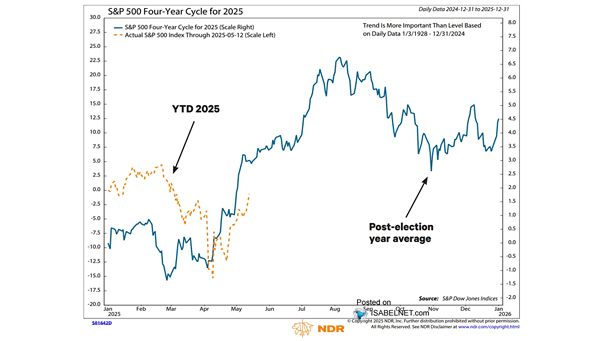

S&P 500 Four-Year Cycle

S&P 500 Four-Year Cycle Although the S&P 500 is facing increased volatility in this post-election year, its performance still aligns with typical patterns observed in the four-year presidential cycle. Image: Ned Davis Research