Philadelphia Semiconductor Index (SOX) Leads Global Manufacturing PMI by Three Months

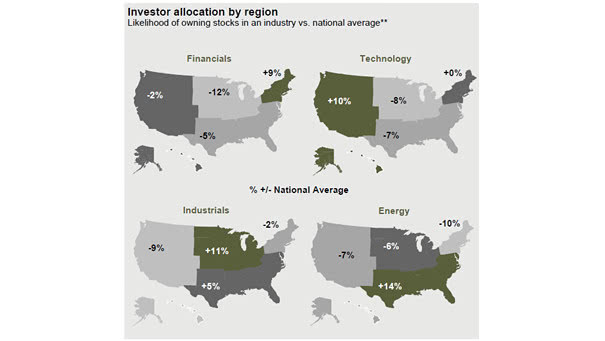

Philadelphia Semiconductor Index (SOX) Leads Global Manufacturing PMI by Three Months This chart suggests that the rally in semiconductor stocks may herald a global growth rebound. Image: Oxford Economics, Macrobond