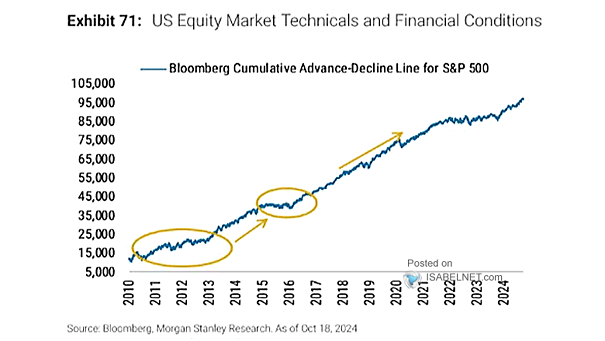

Cumulative Advance-Decline Line for the S&P 500 Index

Cumulative Advance-Decline Line for the S&P 500 Index The S&P 500 advance-decline line is a crucial indicator of market trends and sentiment. An all-time high typically indicates favorable news for the U.S. stock market. Image: Morgan Stanley Research