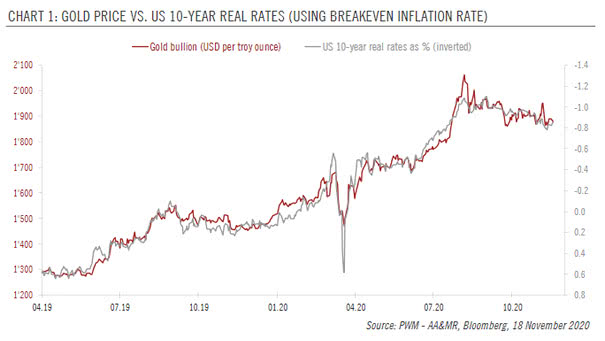

Gold Price vs. U.S. 10-Year Real Rates (Using Breakeven Inflation Rate)

Gold Price vs. U.S. 10-Year Real Rates (Using Breakeven Inflation Rate) Pictet expects gold prices to reach new highs to US$2,150/oz in the next 12 months. Image: Pictet Wealth Management