Aug

26

2025

Off

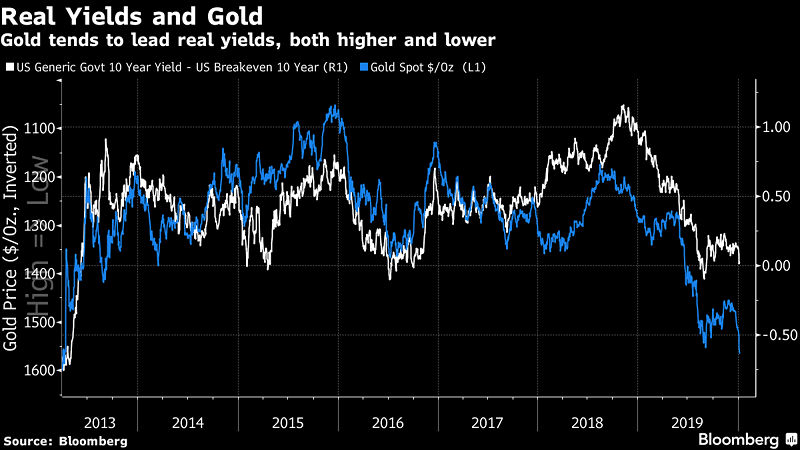

U.S. Real Yields and Gold

Gold’s typical inverse link to real rates is fundamental, but inflation expectations, central bank buying, geopolitical risks, and investor sentiment driven by debt and fiscal worries can disrupt this relationship for extended periods.

Image: Goldman Sachs Global Investment Research