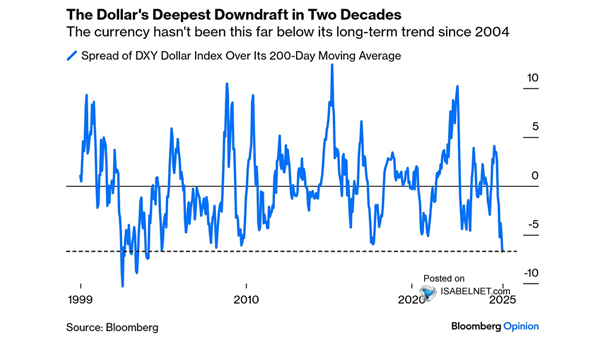

U.S. Dollar and 200-Day Moving Average

U.S. Dollar and 200-Day Moving Average The DXY dollar’s current position well below its 200-day moving average marks a rare bearish phase, the likes of which have not been seen in two decades, signaling a challenging environment for the U.S. dollar in the near term. Image: Bloomberg