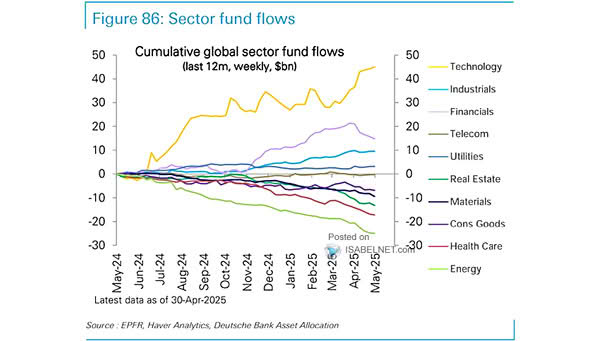

Cumulative Global Sector Fund Flows

Cumulative Global Sector Fund Flows While the technology sector has seen strong inflows over the past year, driven by rapid adoption and expansion of artificial intelligence, the energy sector has experienced significant outflows. Image: Deutsche Bank Asset Allocation