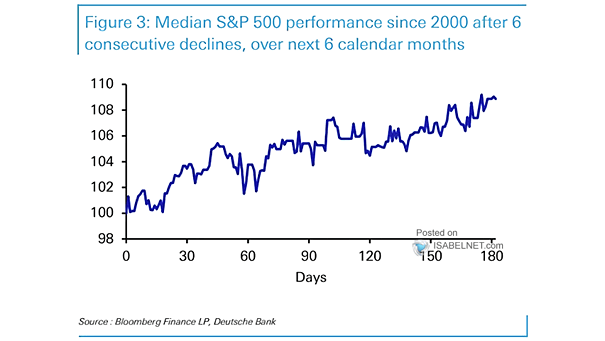

Median S&P 500 Performance

Median S&P 500 Performance Since 2000, the median S&P 500 performance after 6 consecutive declines has been 8.9% over the next 6 months, indicating a potential for a significant rebound and recovery in the stock market. Image: Deutsche Bank