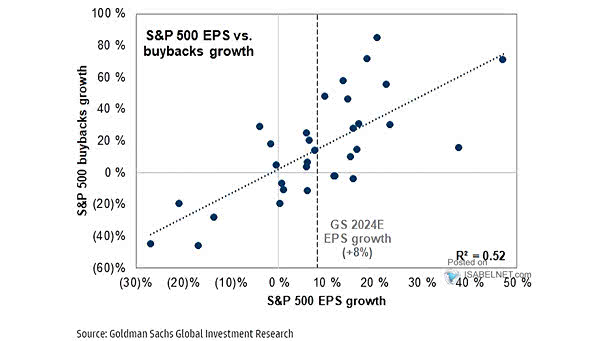

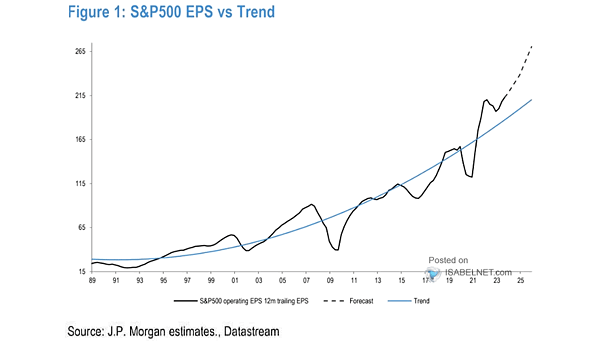

S&P 500 EPS Growth vs. Buyback Growth

S&P 500 EPS Growth vs. Buyback Growth While EPS growth may be one factor influencing a company’s decision to repurchase its own shares, it is just one of many potential drivers of buyback activity. Image: Goldman Sachs Global Investment Research