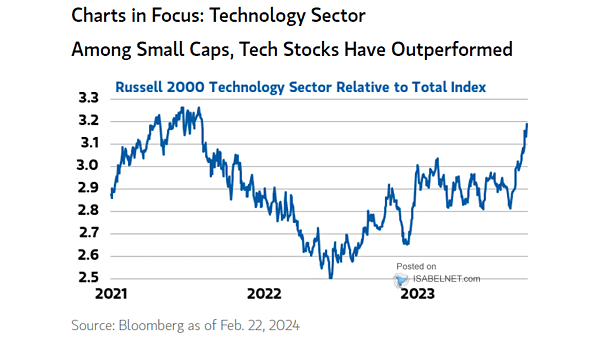

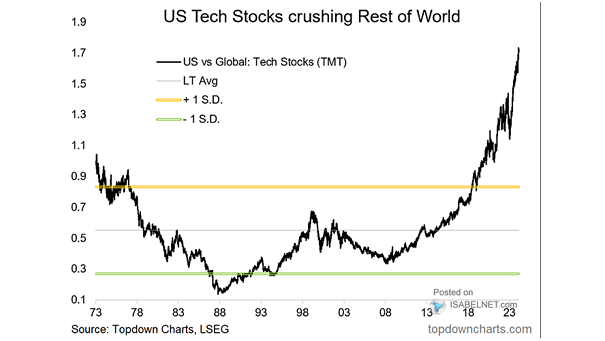

Russell 2000 Technology Sector Relative to Total Index

Russell 2000 Technology Sector Relative to Total Index U.S. small-cap technology stocks have exhibited a noteworthy level of outperformance within the universe of U.S. small-cap stocks, which can be attributed to higher growth potential and the ability to innovate and disrupt traditional industries. Image: Morgan Stanley Wealth Management