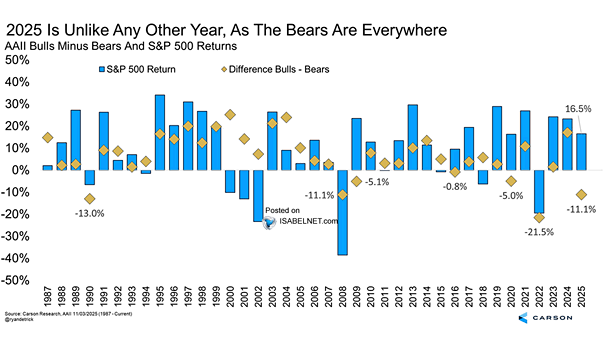

AAII Bulls Minus Bears and S&P 500 Returns

AAII Bulls Minus Bears and S&P 500 Returns The AAII bulls minus bears sentiment spread in 2025 has mirrored bear market extremes from history, reflecting deep pessimism over near‑term stock performance — but to contrarians, that gloom looks like opportunity. Image: Carson Investment Research