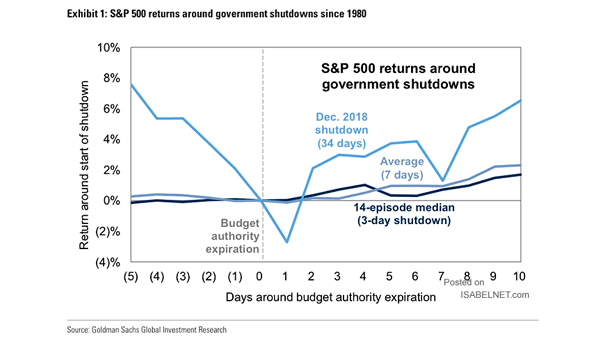

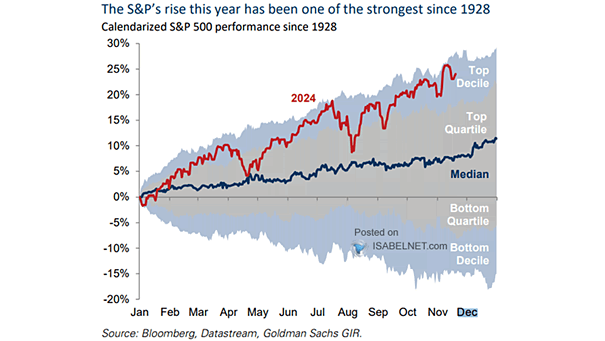

U.S. Government Shutdowns vs. the S&P 500

U.S. Government Shutdowns vs. the S&P 500 For all the political drama, U.S. markets have historically treated government shutdowns as little more than noise, with brief volatility giving way to quick rebounds. Image: Bloomberg