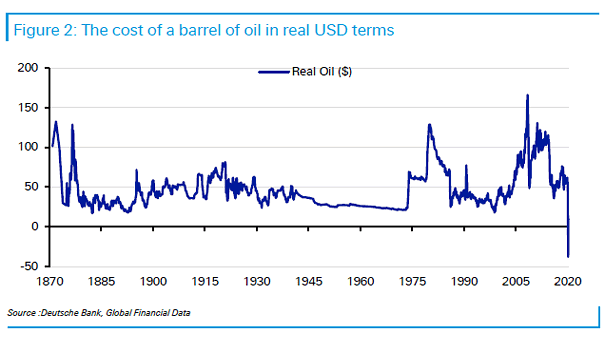

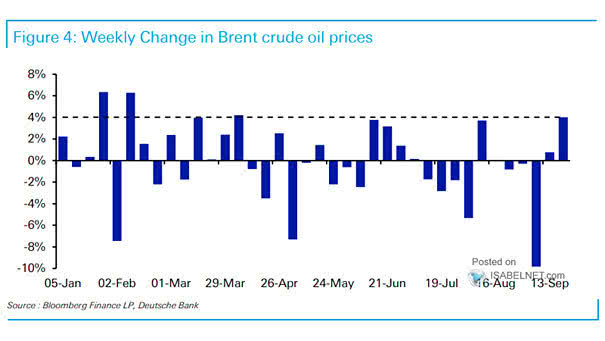

WTI Crude Oil and Recessions

WTI Crude Oil and Recessions Sharp increases in oil prices—often doubling—have been a consistent and significant signal preceding U.S. recessions, making oil prices a key economic indicator to watch for early signs of economic downturns. Image: Yahoo Finance