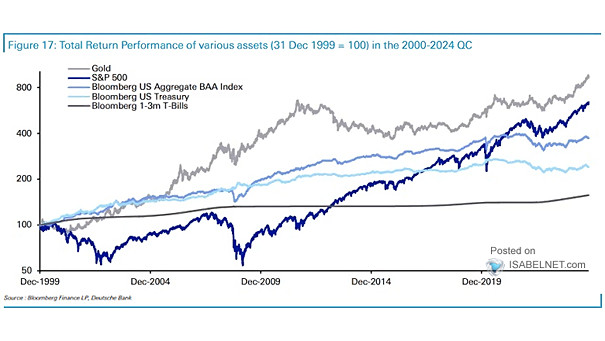

Total Return Performance of Various Assets

Total Return Performance of Various Assets Despite Warren Buffett’s skepticism towards gold as an investment, the precious metal has outperformed both U.S. equities and U.S. Treasury bonds over the past 25 years. Image: Deutsche Bank