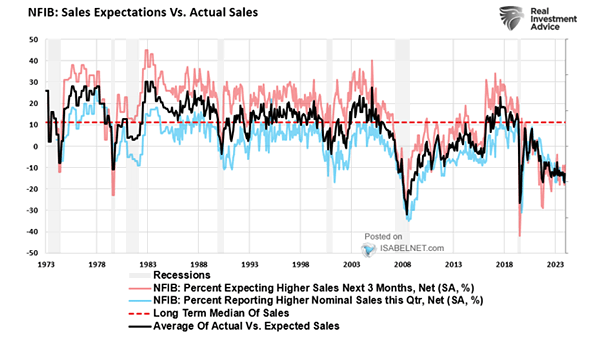

Recession – NFIB Sales Expectations

Recession – NFIB Sales Expectations Optimism among U.S. small business owners regarding future sales has significantly declined, with many anticipating a drop in revenues over the coming months. Image: Real Investment Advice