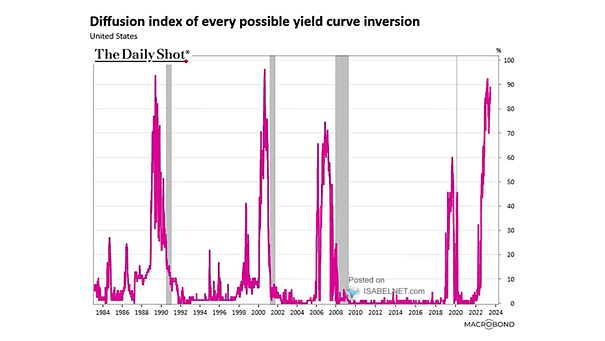

Recession – Diffusion Index of Every Possible Yield Curve Inversion

Recession – Diffusion Index of Every Possible Yield Curve Inversion The increasing number of inverted yield curves is a negative sign, but does not necessarily mean that a recession is imminent. Image: Macrobond