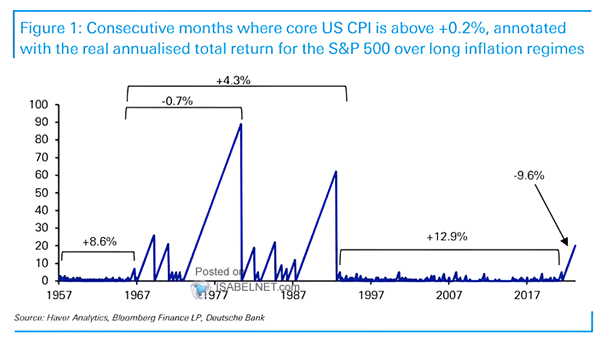

Inflation – Core U.S. CPI and Real Annualized Total Return for the S&P 500

Inflation – Core U.S. CPI and Real Annualized Total Return for the S&P 500 U.S. core inflation above +0.2% MoM typically does not bode well for S&P 500 real returns. Image: Deutsche Bank