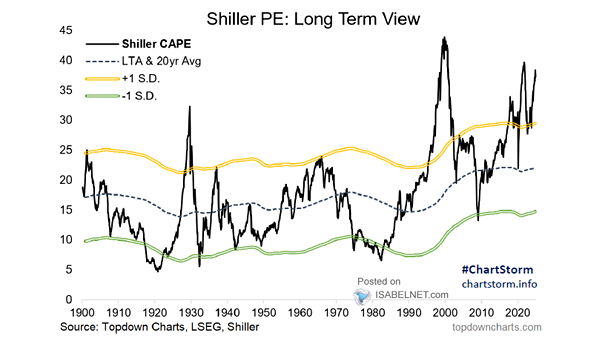

S&P 500 Index – Seasonal 3-Month Forward Return

S&P 500 Index – Seasonal 3-Month Forward Return Historically, this is go-time for the S&P 500. If past trends hold, the next three months could deliver some of the index’s strongest cumulative gains. Image: Renaissance…