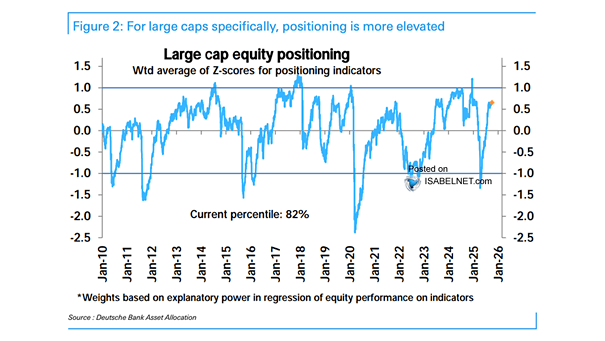

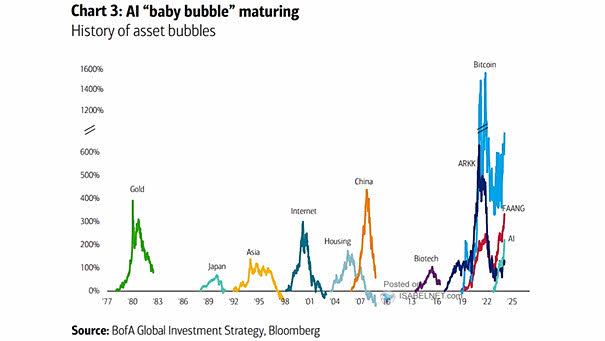

Large Cap Equity Positioning

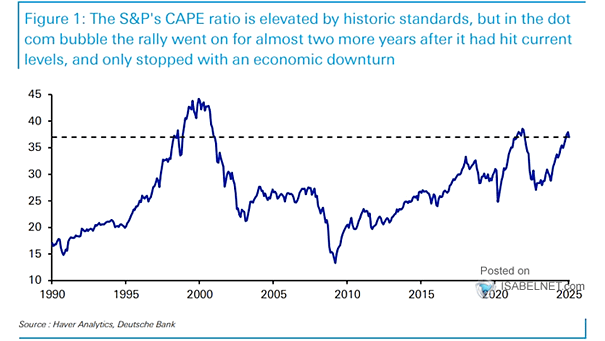

Large Cap Equity Positioning Markets overall are far from stretched, but in large-cap equities, positioning has climbed to the 82nd percentile, where momentum in big-name stocks is clearly picking up. Image: Deutsche Bank Asset Allocation