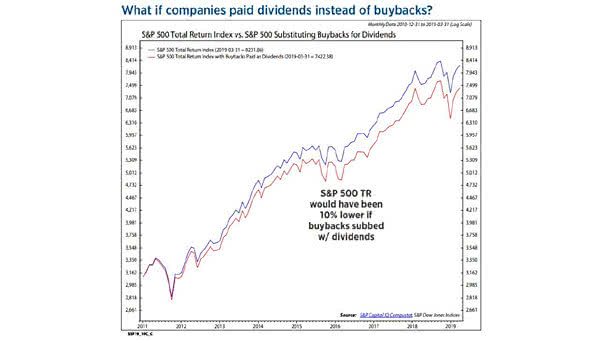

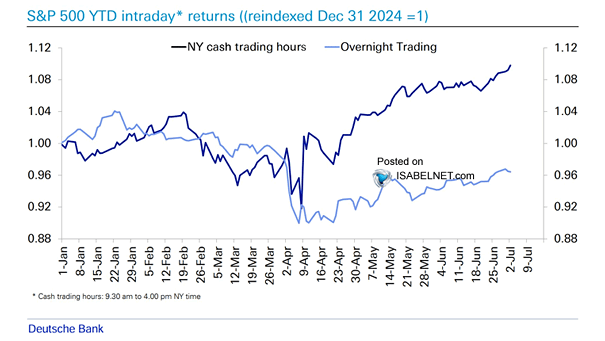

Buyback Aristocrats vs. Dividend Aristocrats

Buyback Aristocrats vs. Dividend Aristocrats Fueled by growth momentum and turbo‑charged buybacks, Buyback Aristocrats have left Dividend Aristocrats in the dust, as investors chase upside over income stability. Image: Goldman Sachs Global Investment Research