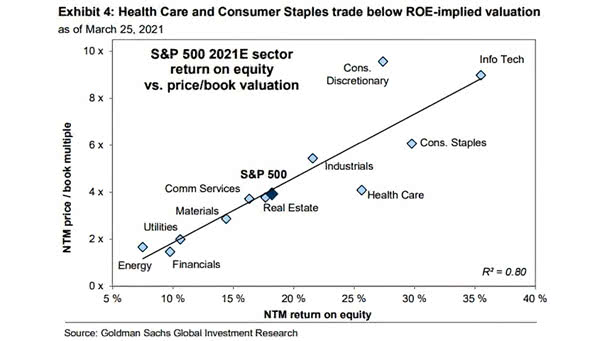

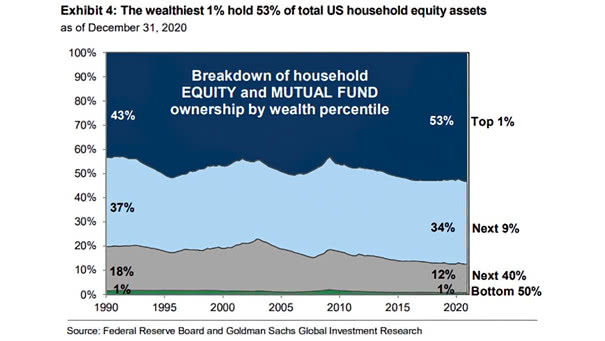

U.S. vs. Non-U.S. Equities Valuations vs. ROE

U.S. vs. Non-U.S. Equities Valuations vs. ROE Investors aren’t shy about paying a premium for U.S. stocks. The payoff? Superior returns on equity and earnings growth that few markets can match. Image: Goldman Sachs Global…