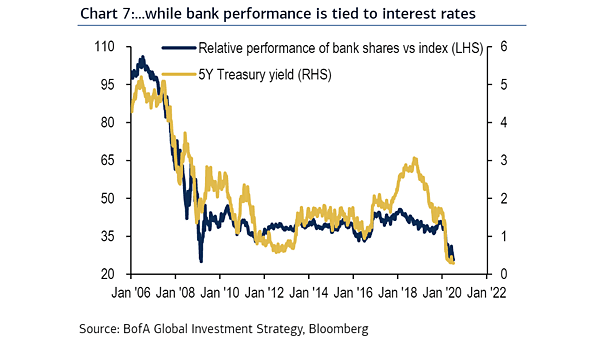

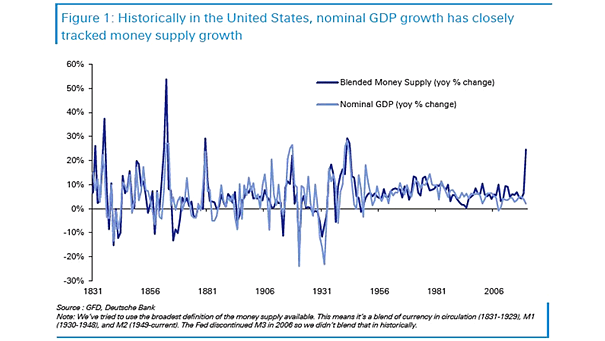

Relative Performance of Bank Shares vs. Index and 5-Year Treasury Yield

Relative Performance of Bank Shares vs. Index and 5-Year Treasury Yield This chart suggests the relationship between interest rates and relative bank performance. Image: BofA Global Investment Strategy