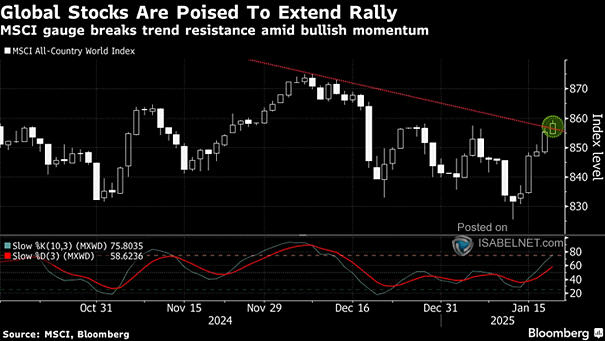

Equities – MSCI U.S. vs. MSCI ACWI ex-U.S.

Equities – MSCI U.S. vs. MSCI ACWI ex-U.S. American equities are falling out of step with their global peers, lagging by roughly 9%—the biggest divide since 2009—amid currency shifts and a revival of interest in…