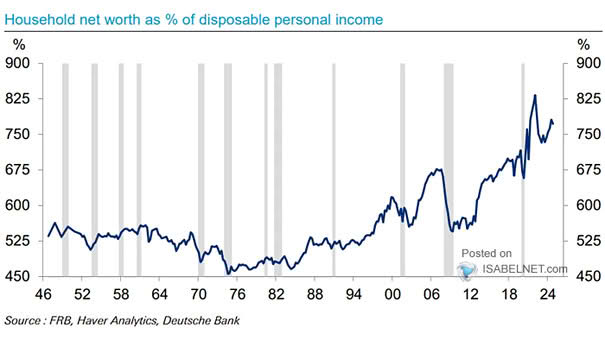

U.S. Household Net Worth as % of Disposal Personal Income

U.S. Household Net Worth as % of Disposal Personal Income While the U.S. household net worth has risen to historic levels due to assets like stocks and real estate, AI-driven financial gains mainly benefit the…