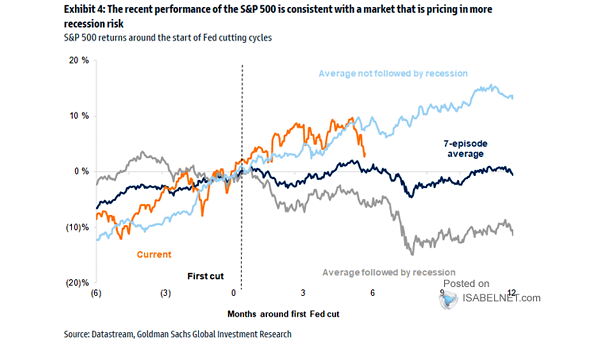

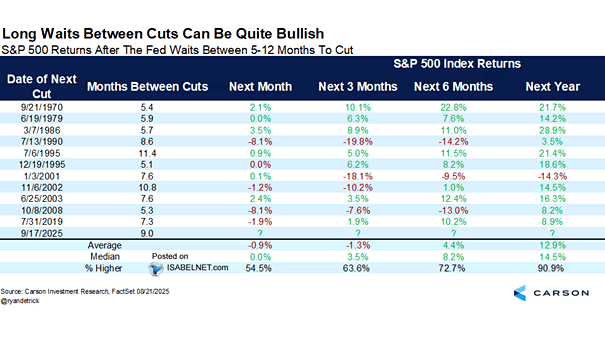

S&P 500 Return Around First Fed Cut After Being on Hold for 6+ Months

S&P 500 Return Around First Fed Cut After Being on Hold for 6+ Months Historically, when the Fed resumes rate cuts after at least six months of holding rates steady, U.S. stocks have often posted…