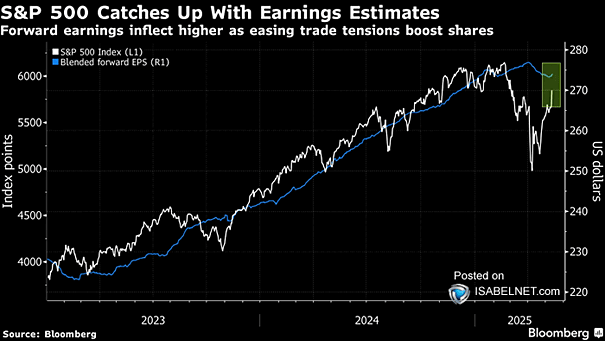

S&P 500 Index and Blended Forward EPS

S&P 500 Index and Blended Forward EPS Citigroup strategists raised their year-end S&P 500 target to 6,600 points, up from 6,300, expecting that tax cuts introduced in July 2025 will counterbalance the negative impact of…