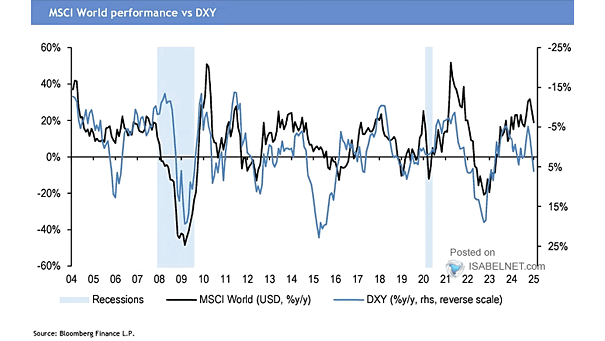

MSCI World Performance vs. U.S. Dollar Index

MSCI World Performance vs. U.S. Dollar Index The link between the US dollar and global equities is often decisive. A softer dollar usually lifts stock markets worldwide, while a firmer one tends to weigh them…