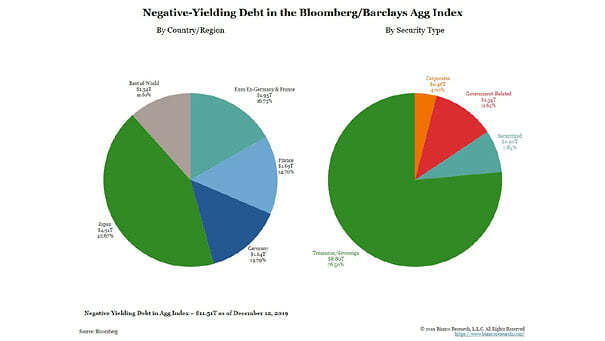

Negative Yielding Debt in the Bloomberg/Barclays Aggregate Index

Negative Yielding Debt in the Bloomberg/Barclays Aggregate Index This chart puts negative yielding debt into perspective. Bondholders will get back less than what they paid if they hold bonds to maturity. Image: Bianco Research Click…