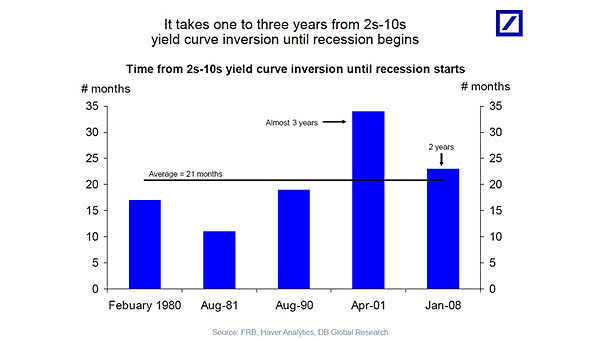

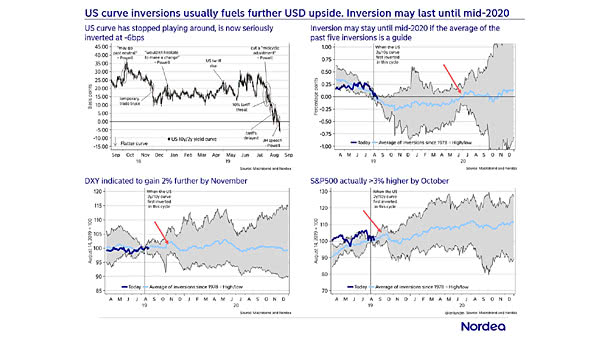

Time from 2s-10s Yield Curve Inversion until Recession Starts

Time from 2s-10s Yield Curve Inversion until Recession Starts Recession tends to start in one to three years after the yield curve inversion. The yield curve is only one indicator among others of an economic…