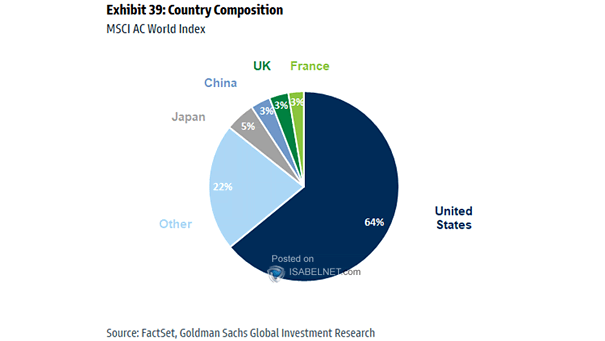

Share of Global Market Capitalization

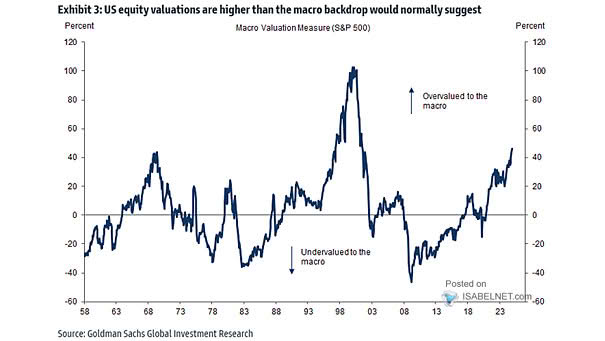

Share of Global Market Capitalization With only 4% of the world’s people, the United States controls 63% of global equity value, its tech and innovation powerhouses attracting massive foreign capital. Image: Goldman Sachs Global Investment…