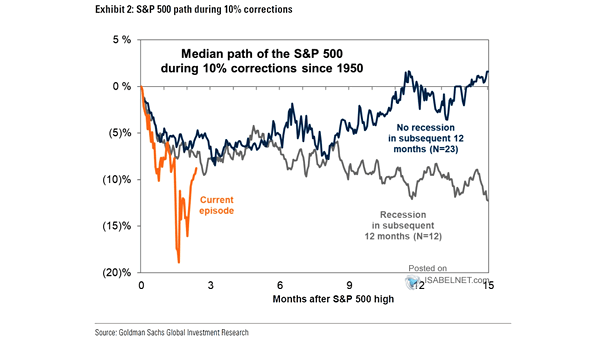

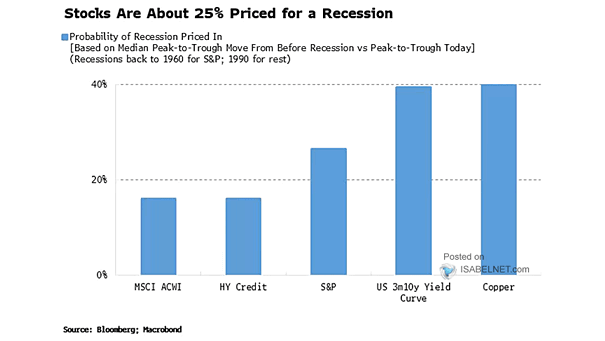

Median S&P 500 Performance During 10% Corrections

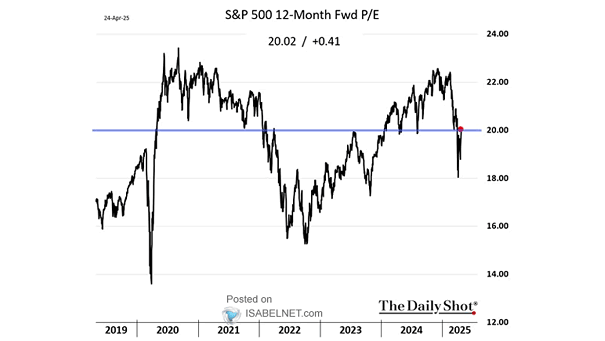

Median S&P 500 Performance During 10% Corrections If there is no recession, U.S. stocks tend to do well after market corrections, often rebounding strongly and offering attractive returns to investors who stay the course. Image:…