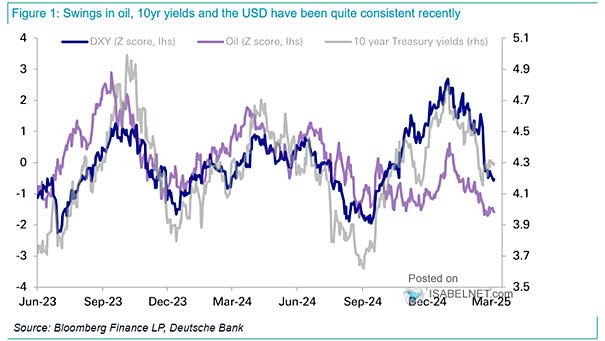

Oil, 10 Year U.S. Treasury Yields and U.S. Dollar

Oil, 10 Year U.S. Treasury Yields and U.S. Dollar The increasing cohesion in recent years between oil prices, 10-year U.S. Treasury yields, and the U.S. dollar reflects deeper economic linkages and heightened sensitivity to policy…