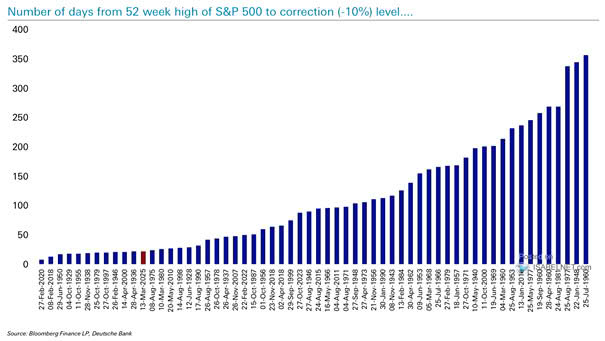

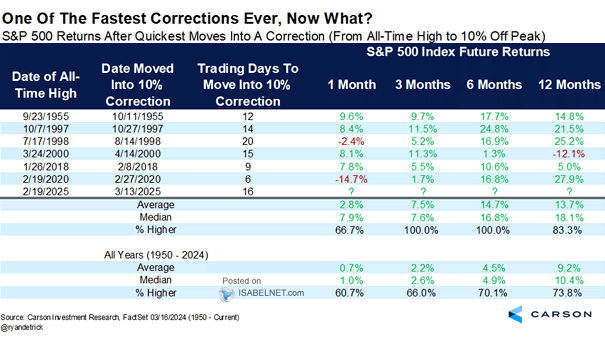

Number of Days from 52 Week High of S&P 500 to Correction (-10%) Level

Number of Days from 52 Week High of S&P 500 to Correction (-10%) Level The current market correction stands out for its swift onset. Among 60 corrections since 1928, this one ranks as the 11th…