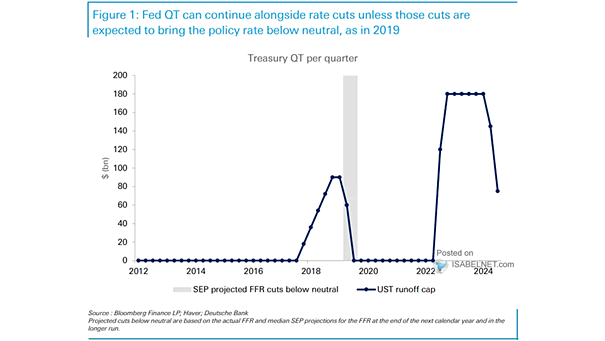

U.S. Treasury Bond Future – 10Y Futures Positions

U.S. Treasury Bond Future – 10Y Futures Positions Speculators have significantly increased their short positions in U.S. Treasury 10Y futures, reflecting a strong bearish sentiment among traders. Image: Deutsche Bank Asset Allocation