Market – Current Pricing of Policy, Political and Macro Outcomes

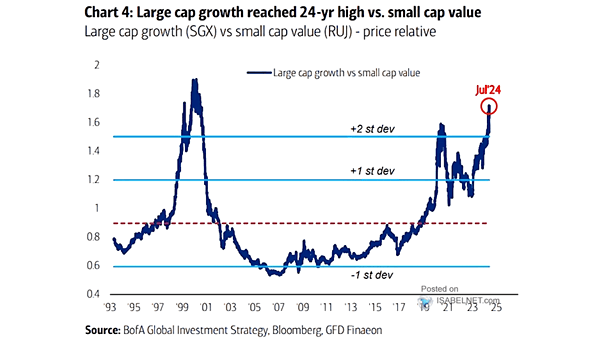

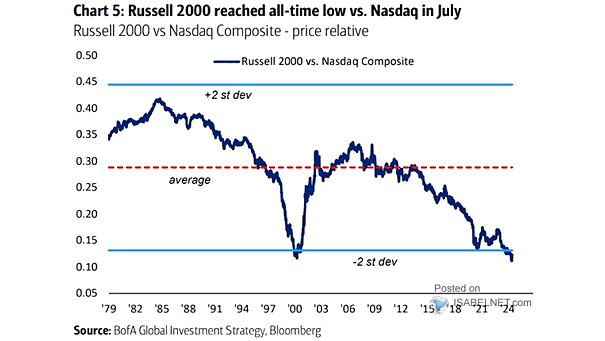

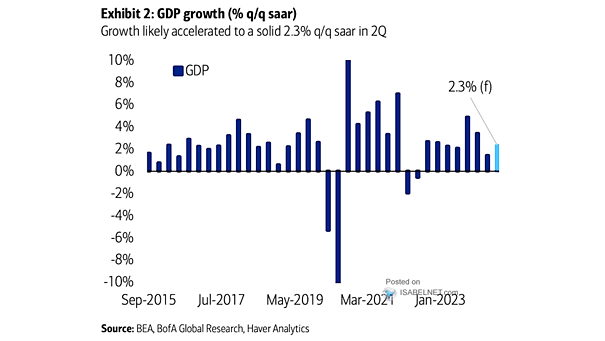

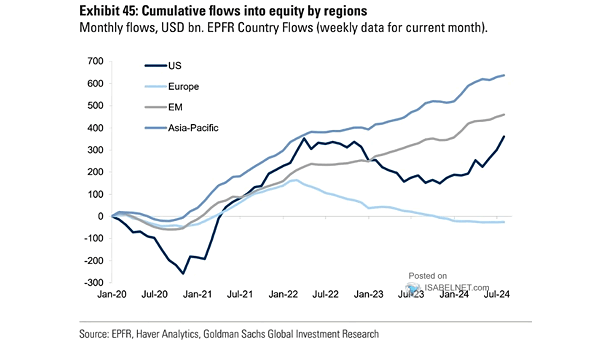

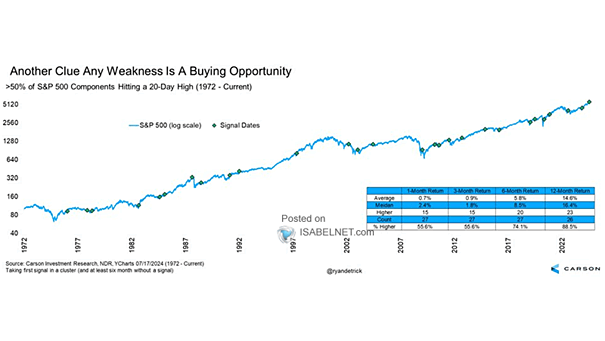

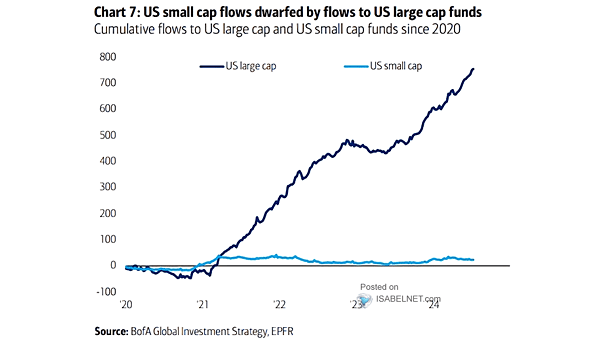

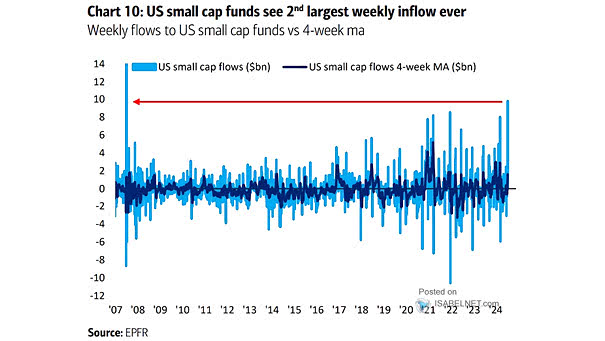

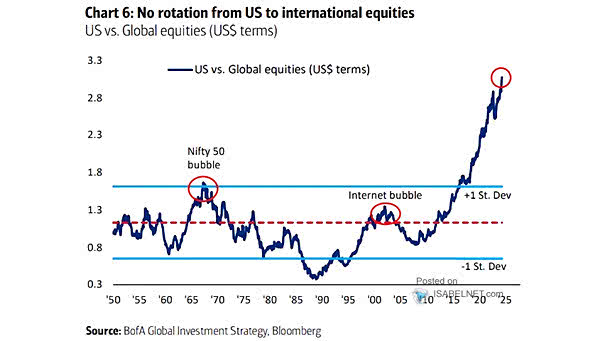

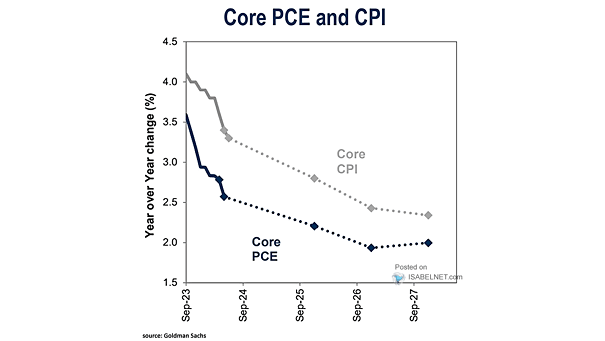

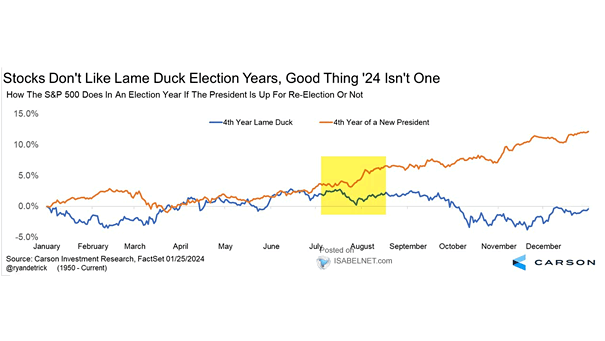

Market – Current Pricing of Policy, Political and Macro Outcomes Investors are confidently predicting a 100% chance of a Fed rate cut on September 18, a 75% likelihood of Donald Trump winning the U.S. election on November 5, and a 68% probability of a soft landing within the next 12 months. Image: BofA Global Investment…