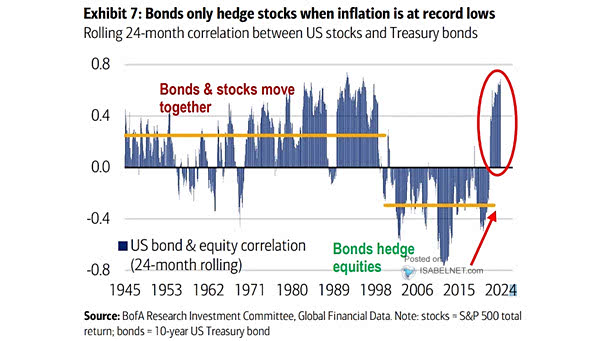

Rolling 24 Month Correlation Between U.S. Bonds and Equities

Rolling 24 Month Correlation Between U.S. Treasury Bonds and Equities Amid high inflation, UST bonds become less effective as a hedge against U.S. stocks, as rising prices erode bond payouts and interest rate hikes lead to a drop in bond prices. Image: BofA Research Investment Committee