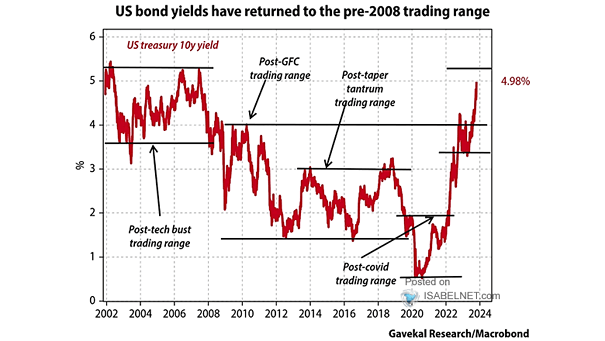

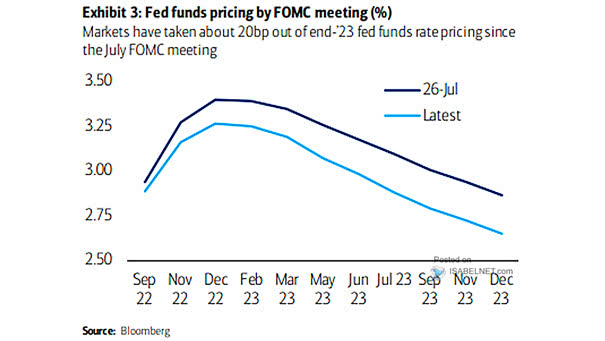

10-Year U.S. Treasury Yield

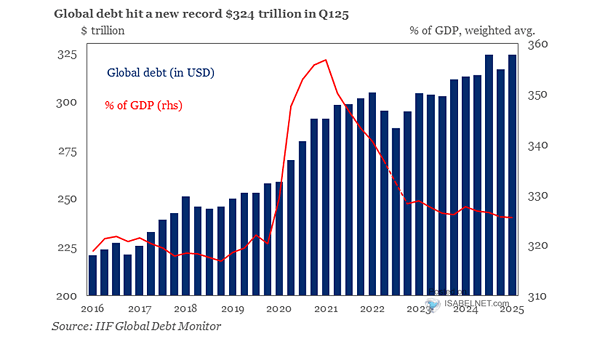

10-Year U.S. Treasury Yield U.S. Treasuries ended a stellar 2025, but few expect a repeat this year. Lower rates may offer some support, but heavy debt issuance, sticky inflation, and ongoing fiscal spending could keep long-end yields from falling much further. Image: Bloomberg