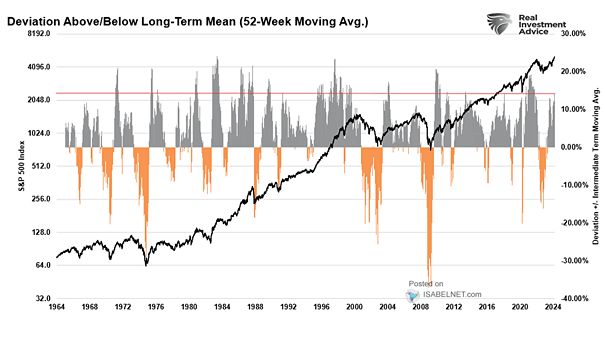

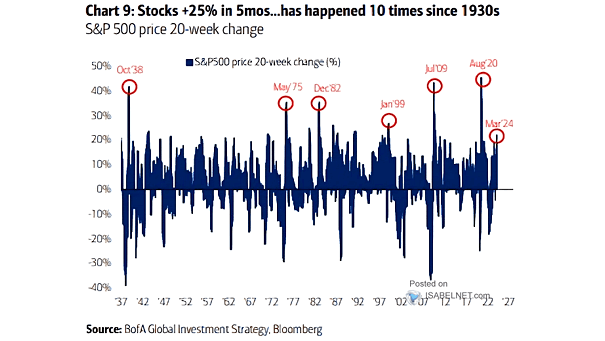

S&P 500 and Deviation Above 50-Day Moving Average

S&P 500 and Deviation Above 50-Day Moving Average As the deviation of the S&P 500 index from its 50-day moving average is reaching extreme levels, speculation mounts regarding the potential for a short-term market correction. Image: Real Investment Advice