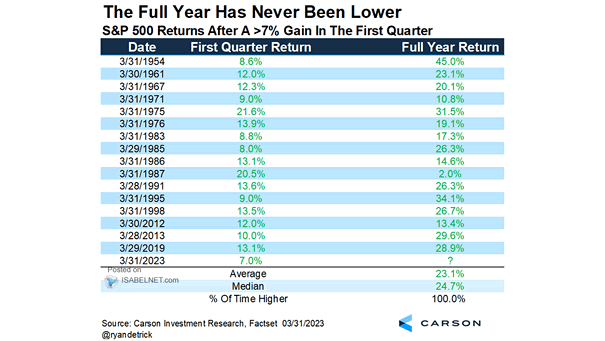

S&P 500 Returns After a >7% Gain in the First Quarter

S&P 500 Returns After a 7% Gain in the First Quarter Since 1954, when the S&P 500 gained more than 7% in the first quarter, bears cried and bulls smiled throughout the year. Image: Carson Investment Research