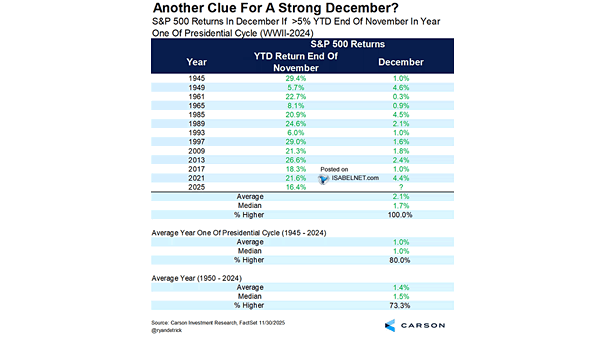

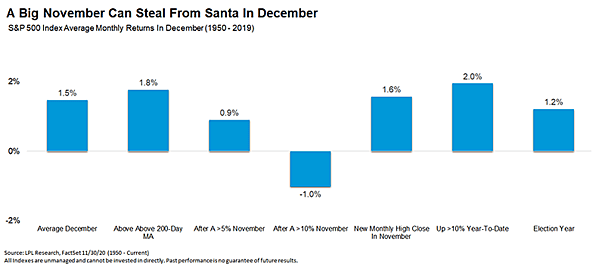

S&P 500 Returns in December if >5% YTD End of November in Year One of Presidential Cycle

S&P 500 Returns in December if >5% YTD End of November in Year One of Presidential Cycle Bulls are in luck. Since 1945, whenever the S&P 500 was up more than 5% YTD by November’s end in the first year of a presidential cycle, December has never missed and kept the rally going with an…