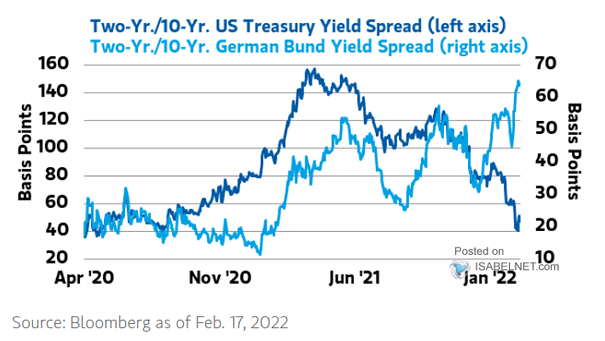

Yield Curve – 2Y/10Y U.S. Treasury Yield Spread and 2Y/10Y German Treasury Yield Spread

Yield Curve – 2Y/10Y U.S. Treasury Yield Spread and 2Y/10Y German Treasury Yield Spread The U.S. and German yield curves are decoupling, suggesting a slower economic activity in the United States. Image: Morgan Stanley Wealth Management