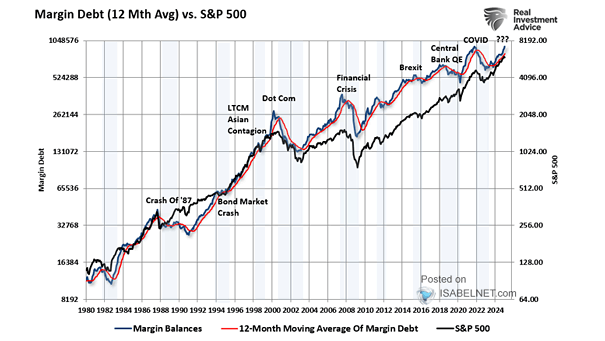

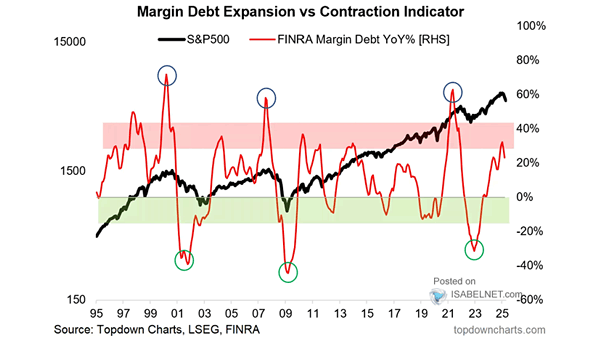

S&P 500 vs. Margin Debt

S&P 500 vs. Margin Debt Rising margin debt fuels rallies and reflects strong investor confidence, but once it slips below key trendlines like the 12‑month average, it flags fading risk appetite and growing market fragility. Image: Real Investment Advice