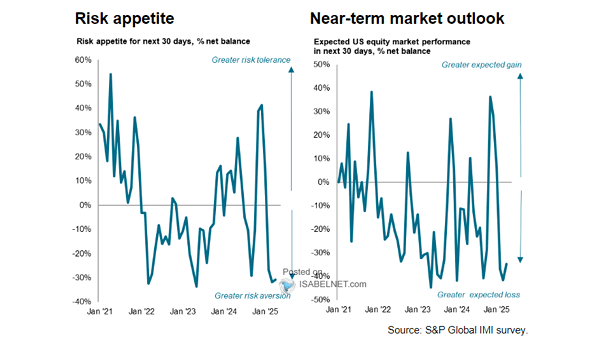

Sentiment – Risk Appetite and Expected U.S. Equity Market Performance

Sentiment – Risk Appetite and Expected U.S. Equity Market Performance Risk appetite is surging among U.S. equity fund managers, who are betting on robust returns, as optimism builds around rate cuts, economic momentum, and earnings strength. Image: S&P Global Market Intelligence