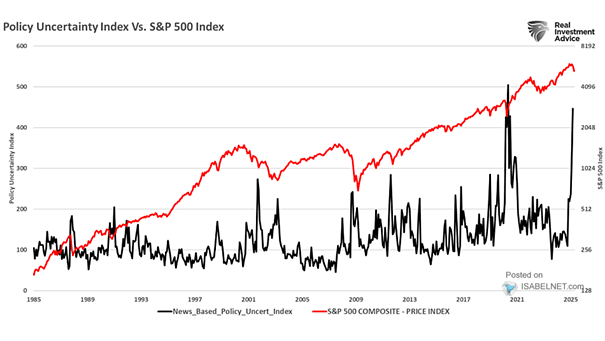

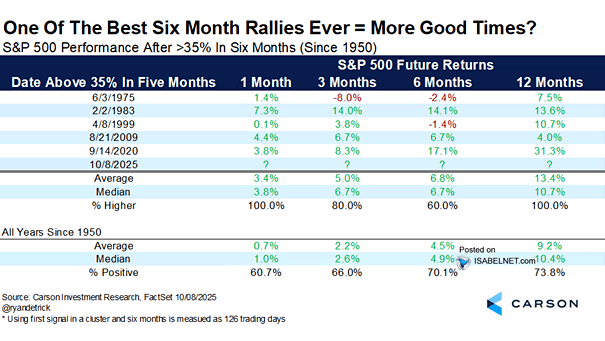

Policy Uncertainty Index vs. S&P 500 Index

Policy Uncertainty Index vs. S&P 500 Index Policy uncertainty often rattles markets—but those jitters tend to be short-lived, with volatility typically hitting peak levels near market lows. Image: Real Investment Advice