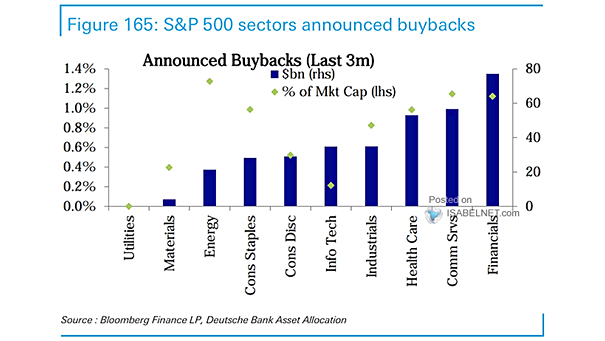

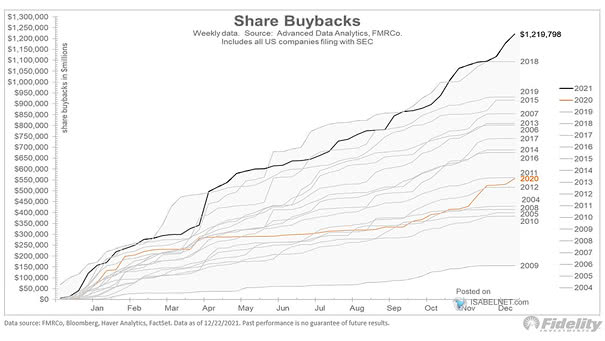

S&P 500 Sectors Announced Buybacks (Last 3 Months)

S&P 500 Sectors Announced Buybacks (Last 3 Months) Over the past three months, the Financial, Industrial, and Information Technology sectors have been at the forefront of buyback announcements, driving a major portion of repurchase activity in the U.S. market. Image: Deutsche Bank Asset Allocation