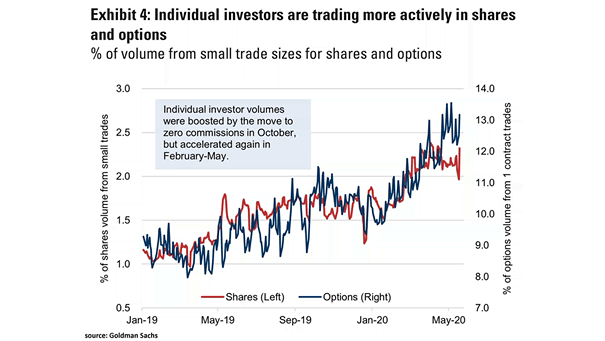

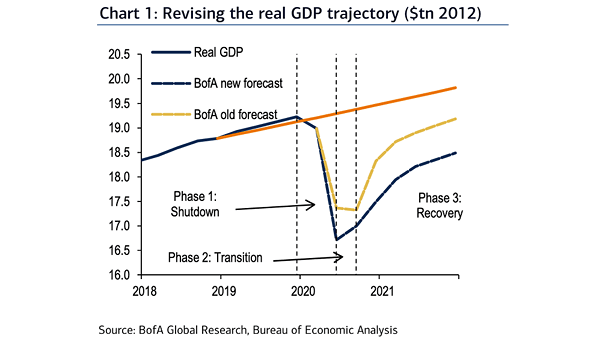

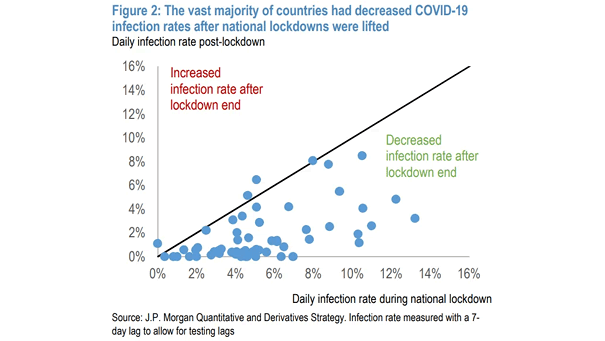

Individual Investors Are Trading More Actively in Shares and Options

Individual Investors Are Trading More Actively in Shares and Options The move to zero commissions in October and the lockdowns boosted individual investor volumes. Image: Goldman Sachs Global Investment Research