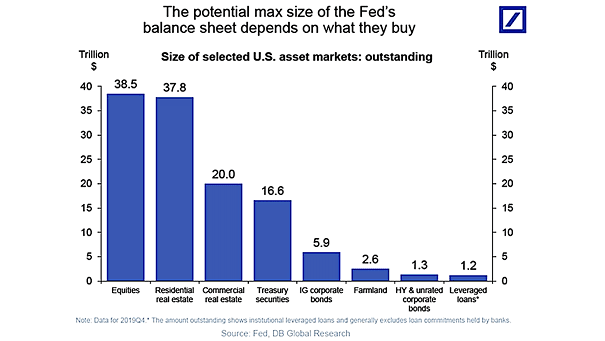

Size of Selected U.S. Asset Markets

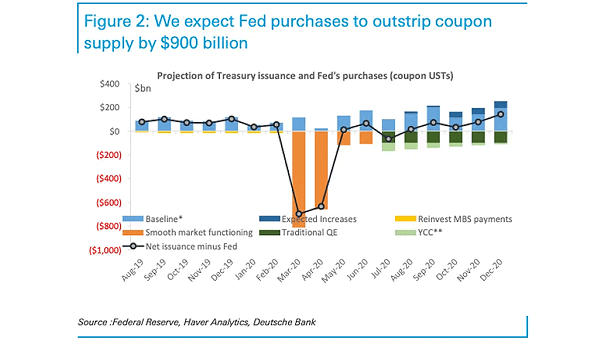

Size of Selected U.S. Asset Markets This chart puts into perspective the size of selected U.S. asset markets. The U.S. stock market is more than twice as large as the U.S. Treasury market. Image: Deutsche Bank Global Research