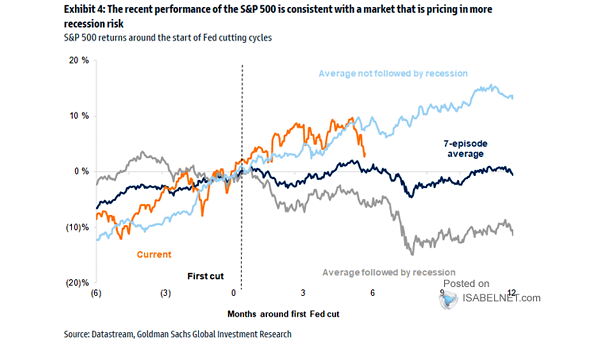

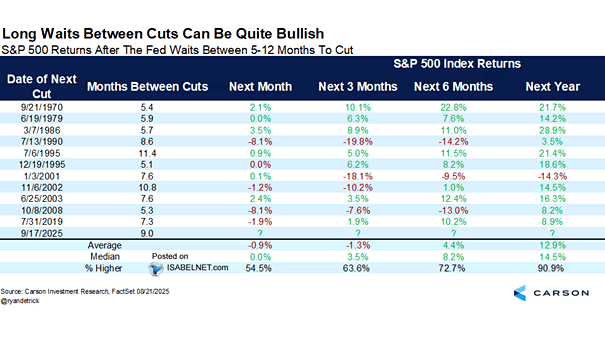

S&P 500 Return Around First Fed Cut After Being on Hold for 6+ Months

S&P 500 Return Around First Fed Cut After Being on Hold for 6+ Months Historically, when the Fed resumes rate cuts after at least six months of holding rates steady, U.S. stocks have often posted strong returns in the subsequent 12 months, particularly if economic growth persists. Image: Goldman Sachs Global Investment Research