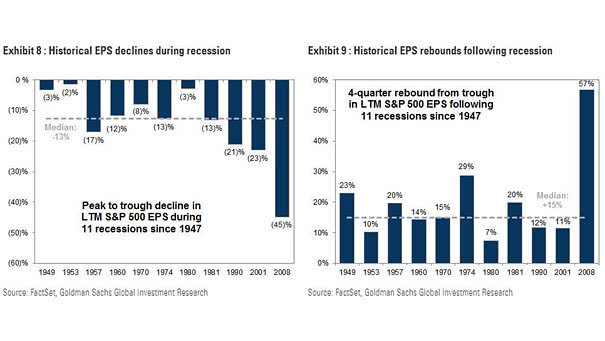

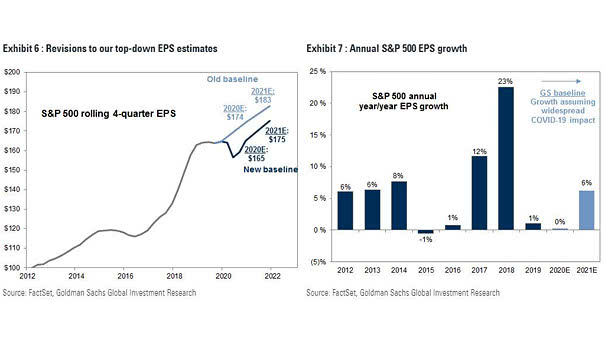

Historical EPS Declines during Recession and Historical EPS Rebounds following Recession

Historical EPS Declines during Recession and Historical EPS Rebounds following Recession Historically, S&P 500 EPS fall by 13% from peak to trough and rebound by 15% in the four quarters following recession. Image: Goldman Sachs Global Investment Research