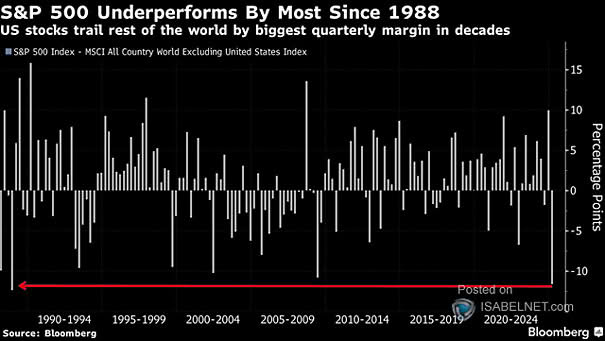

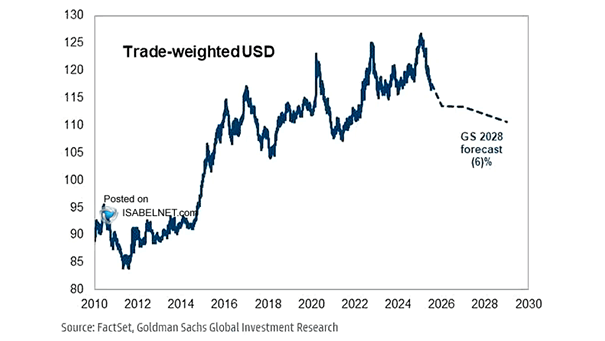

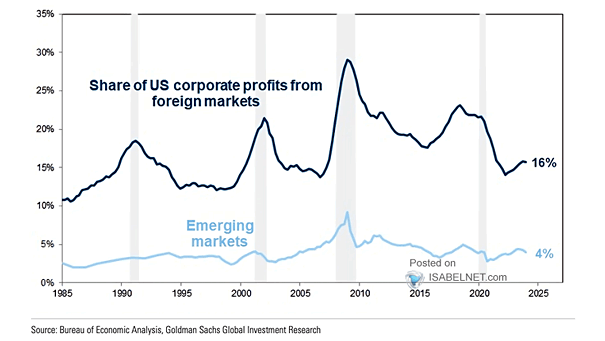

S&P 500/MSCI World and U.S. Dollar Trade-Weighted Index

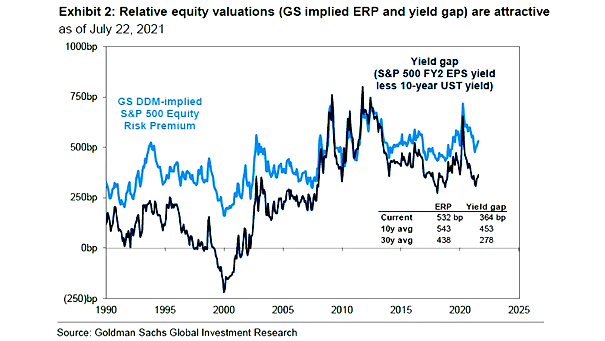

S&P 500/MSCI World and U.S. Dollar Trade-Weighted Index The renewed relative strength and attractiveness of U.S. assets amid global uncertainty and monetary policy differentials have played a central role in driving the U.S. dollar’s recent rebound Image: Goldman Sachs Global Investment Research