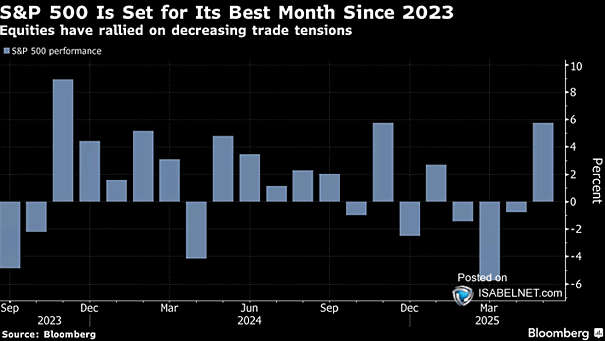

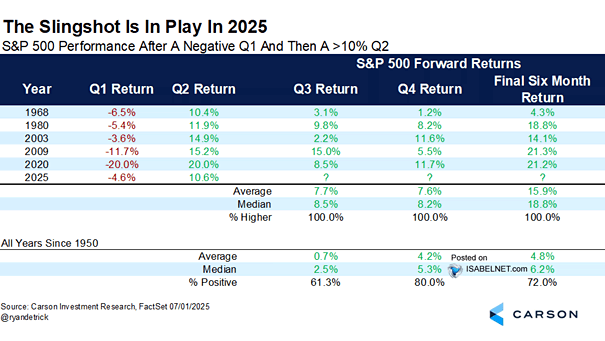

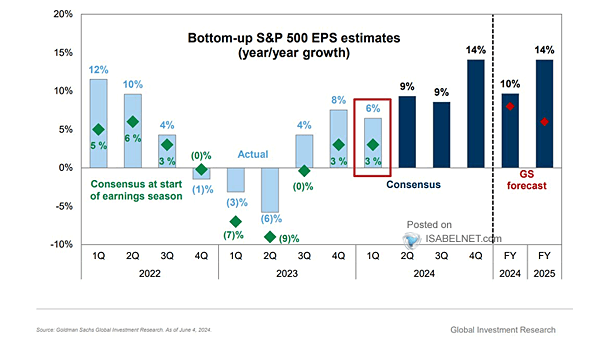

S&P 500 Performance

S&P 500 Performance While the S&P 500 is on track for a third consecutive monthly gain, supported by strong earnings expectations, some investors remain cautious about its sustainability given high valuations and geopolitical uncertainties. Image: Bloomberg